We look at how the RBA rate cut and the APRA change to the interest rate buffer might help property buyers and existing owners.

RBA rate cut

Earlier this month the Reserve Bank (RBA) cut the official interest rate. Commonwealth Bank and National Australia Bank passed on the full rate cut of 25 basis points. ANZ and Westpac passed on some of the rate cut and a number of smaller banks have followed.

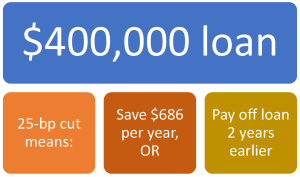

What does a 25-basis point cut mean in Dollar terms?*

What does a 25-basis point cut mean in Dollar terms?*

- On a $400,000 standard variable loan, a borrower might save around $686 per year.

- If it is an interest-only loan, the savings would be around $1,000 per year.

These savings may sound low compared with the loan size and payments but could help pay off your loan sooner. If the saving of $686 was paid into the loan every year instead of keeping it in your pocket, you could pay off your loan a whole two years earlier.

Why did the RBA cut rates?

One of the main reasons was to stimulate employment growth. When rates go down, businesses feel more confident to expand because it’s costing them less in interest to finance their expansion. With expansion plans and increases in turnover, businesses need more staff and so the cycle of employment growth starts.

APRA changes to interest rate buffer

The Australian Prudential Regulation Authority (APRA) proposes to reduce loan interest rate buffer requirements to 2.5% over the actual loan interest rate. This means, where banks typically calculate a home buyer’s borrowing capacity using a 7.25% interest rate, on a 3.99% loan it might be calculated using a rate of 6.49% after the change.

What difference does the APRA change make? **

A borrower who now qualifies for a loan of $400,000 could qualify for $433,000 after the change to the interest rate buffer. If the 25-basis point rate cut is also applied, the borrower could qualify for $444,000. That is $44,000 extra and makes a great difference in the choices available to the buyer. It could mean getting into their preferred suburb or having that extra bedroom they need for their kids.

How do these changes affect the Perth property market?

The Perth property market has been struggling since its peak in 2004. Now, the interest rate reduction together with APRA’s proposed relaxation will be a great boost. But on their own they are not enough to kick start the market.

The positives, though, are starting to accumulate, with the latest good news drivers to nudge the market forward being

- Banks to soon loosen up after too-tight lending had pushed many buyers out of the market

- Competition has recently seen many small lenders drop rates to well under 4%, sometimes even below 3.5%

- Further reductions due to drop in official rate

- LNP win at the election keeping negative gearing and capital gains intact

- WA economy grew 9% last year – a pre-cursor to jobs growth

- WA exports grew significantly, with iron ore prices at a high

- Infrastructure WA to boost the state economy and jobs growth

- Rental occupancies on the way up paving way for rent increases

- Properties now more affordable than ever

- A surge in mining jobs – almost 90,000 full-time

- WA is 2nd most attractive place in the world for mining investment

Your 5-Step Guide to Strategic Property Investment (eBook)

For a property price recovery to get going in full swing we need to see more first home buyers providing a lift for people to trade up; we need to see the benefits of the mining jobs growth and an improvement in employment across the board. In the meantime, it’s critical to be selective and do thorough research as there are several pockets of areas and property types that are doing well.

It’s also vital not to wait too long and potentially miss the boat. Many buyers discovered this to their detriment in the previous upturns as they waited for certainty and media confirmation, which comes long after the ship has sailed.

(*$400,000 loan, principal and interest for 30 years, repayment at interest rate of 3.99% is $1,907.36 pm and at 3.74% is $1,850.19 pm, a difference of $685.95 pa. For interest only on a $400,000 loan, at 3.99% it is $15,960 pa and at 3.74% it is $14,960 pa.)

(** $400,000 loan, principal and interest for 30 years, assessed on income of $68,000pa at interest rate of 7,25%; then at 3.99% rate plus buffer of 2.5% which is 6.49%, then at 25bp cut which is 6.24%.)

NEED FINANCE?

If you’re ready to invest and you’ve got any questions about finance, call us for a free Financial Health Check: 08·9381·7450 or download our Finance Services information.

CONNECT WITH US

To stay up to date with our latest information, property news and blog posts, you can subscribe, or follow us on Facebook and Twitter

Property Wizards believes everyone has the right to the knowledge to help you accumulate wealth, no matter your background, education or income.

Property Wizards believes everyone has the right to the knowledge to help you accumulate wealth, no matter your background, education or income.

We can help you unlock the potential of the real estate market for your family through savvy property selection, negotiation on price and conditions, development expertise and the magic of robust research.

Regardless of market conditions, our research, local knowledge, and access to silent sales means we find the hidden gems that can outperform the market in capital growth and rental returns for long term wealth creation.

Importantly, we’re able to provide property investors and homebuyers with the same level of representation that property sellers have benefited from for years.

Your property portfolio is your path to financial freedom and the lifestyle you’ve been longing for.

Property Wizards takes away the stress of buying a property and saves you money at the same time. We can show you how, or you can sit back and let us do all the hard work for you.